Baseline Summary

Demography

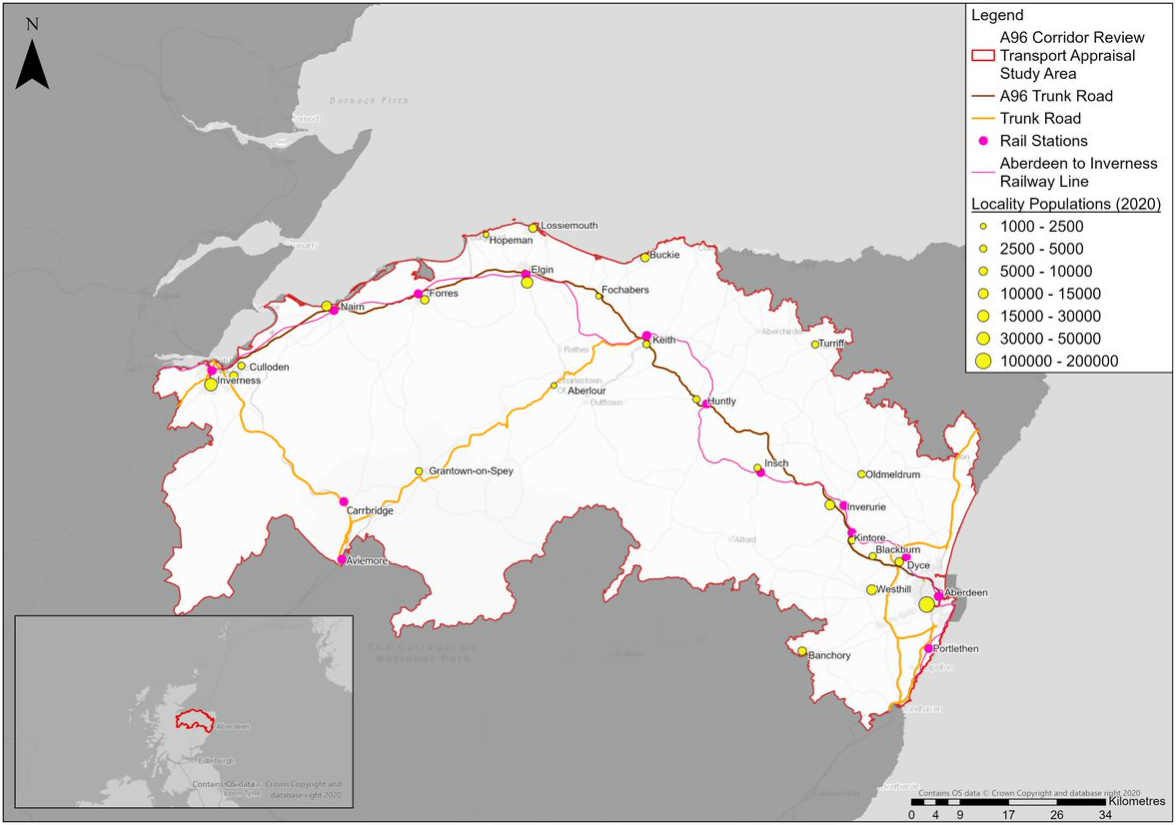

The Case for Change Report provides a detailed profile of the demographic conditions within the A96 Transport Appraisal Study Area, which is the study area defined in the report. This is shown in Figure 5‑1, taken from the Report. It encompasses sections of the four local authority areas of Aberdeen City Council, Aberdeenshire Council, Moray Council and The Highland Council.

The total population within this study area, as indicated in Figure 5‑2, is just under 551,000. Population density across the study area is slightly greater than Scotland as a whole, though this is only a result of the heavily dense population in Aberdeen, the third largest population area and city in Scotland, behind only Glasgow and Edinburgh. Considering the other three LA areas within the study boundary, the population density is only 47 persons per sq. km, indicating a much sparser population and greater rurality than across Scotland as a whole.

Approximately 48.4%, 47.4% and 41.6% of the populations of Aberdeenshire, Moray and Highland respectively live in areas classified by the Scottish Government as ‘rural’.

Users of the A96

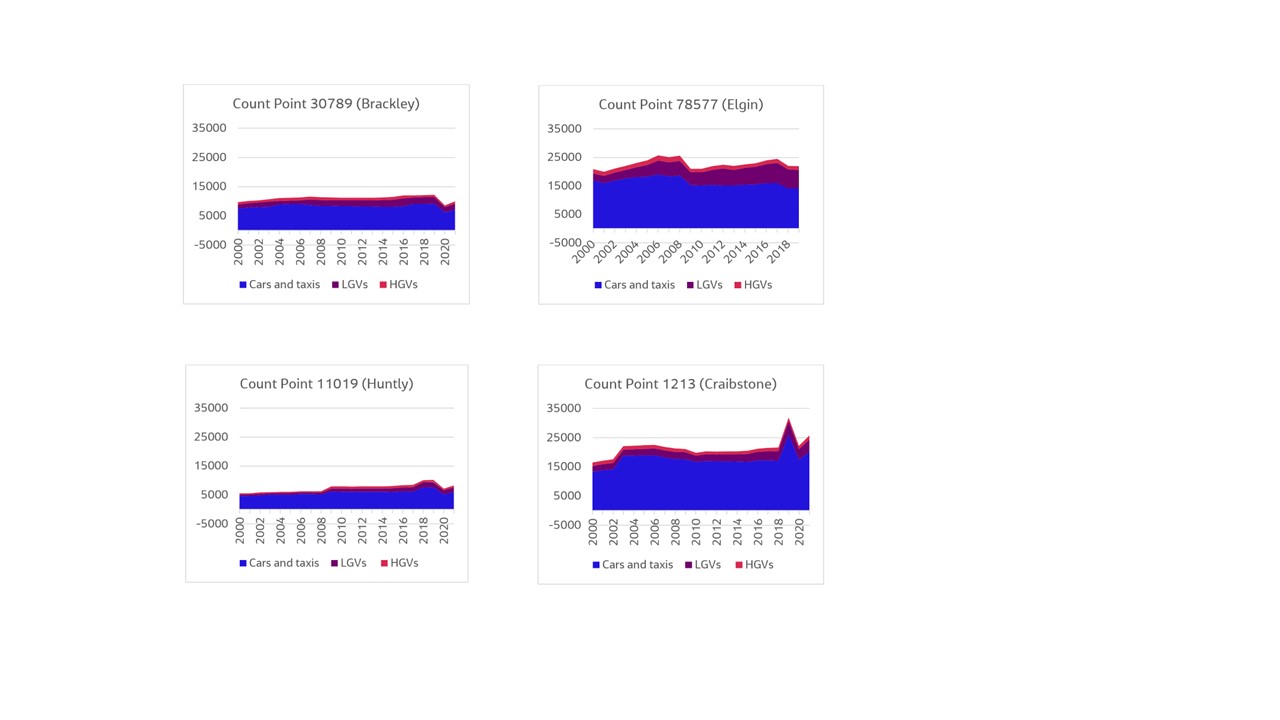

Data from the Department for Transport ( Department for Transport (2022) Road Traffic Statistics: Average Annual Daily Flow ) shows the average annual daily flow (AADF) meaning the number of vehicles that travel passed a count point on an average day of the year.

Figure 5‑3: Traffic Counters at Various Count Points Along A96 (Source: Department for Transport)

Figure 5-3 illustrates the proportion of road users along the A96 at different count points in a variety of locations, both rural and urban. The majority of users of the road mainly travel by car, with up to 20,000 trips per day at count point 78577 (Elgin). HGVs and LGVs account for a much smaller proportion of trips at each count point, with a relatively higher proportion at Elgin in comparison to other count points. The road is particularly busy at more urban locations, such as count point 1213 (Craibstone), with AADF up to 32,000 in 2019.

HGV presence can be a good indicator of business travel on roads. In Scotland overall, HGVs account for around 6% of the total traffic volume on roads. ( Transport Scotland (2022) Scottish Transport Statistics 2022: Road Traffic ) The Case for Change Report notes that across all traffic counters along the A96, up to 16% of vehicles in 2019 were HGVs and in general the proportion of these vehicles is above 8% for the whole route; a higher rate than average for Scotland. It is clear that the road is important for the movement of goods and freight, and therefore for business.

Data from the Scottish Household Survey ( Transport Scotland (2019) Transport and Travel in Scotland 2019: Results from the Scottish Household Survey. ) shows that the main mode of transport for households is car. The Survey reports that less than 3% of trips are for business purposes and 23% are for commuting. However, most trips are for non-work purposes such as shopping (24%), visiting friends and relatives (10%), entertainment (6%), and education (6%).

Freight statistics from the Department for Transport ( Department for Transport (2022) Domestic Road Freight Activity (RFS01). ) , as shown in Table 5‑1, provide an overview of goods moved by commodity across Great Britain. Data shows that road freight volume is high in the food and beverage, mining and quarrying, and agricultural industries and so it is likely that the majority of road freight is found in these sectors.

The Case for Change Report shows that freight traffic is heavily dependent on the A96 to provide access to key markets and destinations, including ports and harbours near to the A96 and beyond.

| Commodity | Goods moved (million tonne km) |

|---|---|

|

Food products, including beverages and tobacco |

31,690 |

|

Metal ore and other mining and quarrying |

16,961 |

|

Waste related products |

13,529 |

|

Agricultural products |

11,987 |

|

Empty containers, pallets, and other packaging |

10,967 |

|

Glass, cement, and other non-metallic mineral products |

8,218 |

|

Wood products |

6,807 |

|

Chemical products |

6,782 |

|

Coke and refined petroleum products |

4,896 |

|

Mail and parcels |

4,498 |

|

Metal products |

4,014 |

|

Transport equipment |

3,666 |

|

Household and office removals and other non-market goods |

2,504 |

|

Machinery and equipment |

2,148 |

|

Textiles and textiles products, leather, and leather products |

1,038 |

|

Furniture and other manufactured goods |

1,026 |

|

Coal and lignite |

198 |

Source: Department for Transport (2022).

Businesses along the A96

It is likely that LGV and HGV journeys are most commonly used by businesses in industries such as agriculture, timber, energy, and logistics, where transportation of large material is necessary.

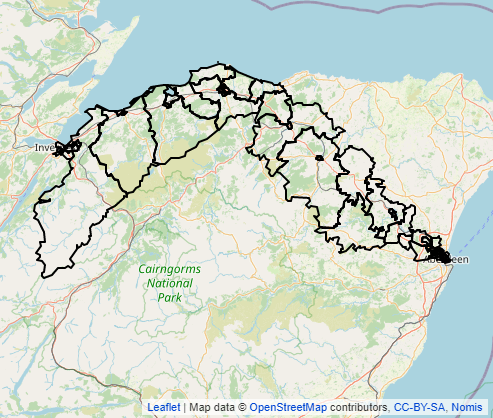

Business count data for Scottish Intermediate Zones (outlined in Figure 5‑4) within the A96 Corridor Review study area is set out in Table 5‑2 . ( ONS (2022) UK Business; activity, size and location: 2022 ) This shows that there is a high presence of construction, agriculture, forestry, and fishing businesses located along the A96, but fewer in industries such as mining, quarrying, and utilities. When broken down further (by two-digit Standard Industrial Classification (SIC) code), data shows that a large number of businesses along the A96 are related to crop and animal production services.

| Industry | Business Count |

|---|---|

|

Agriculture, forestry and fishing |

1,175 |

|

Crop and animal production |

1,035 |

|

Forestry and logging |

100 |

|

Fishing and aquaculture |

40 |

|

Manufacturing |

580 |

|

Manufacture of food and beverages |

30 |

|

Manufacture of wood |

30 |

|

Manufacture of fabricated metal products |

110 |

|

Transport and storage |

420 |

|

Postal and courier services |

155 |

|

Mining, quarrying and utilities |

90 |

|

Electricity, gas, steam, and air conditioning supply |

10 |

Source: ONS (2022) UK Business Counts. Note - not every two-digit SIC code industry is captured in the breakdown .

It is also outlined in the Case for Change Report that the food and drink industry is a key sector nationally, regionally and locally, with Moray being home to world-renowned brands in food and drink such as Walker’s Shortbread, Baxters and Speyside whisky. With Moray home to approximately 44% of all malt whisky distilleries in Scotland, the A96 Trunk Road is integral to the sector. ( HITRANS (2011) Whisky Logistics Study )

The timber and logging industry is another prominent industry in the region, with the individual Grampian and Highland Regional Timber Transport Group’s estimating a combined production of over 20 million tonnes of timber from 2020 to 2029.

The strong reliance on trade and production in industry means a high proportion of freight travel along the A96. Industries such as food and drink production, agriculture and fishing all require the movement of goods to maintain business productivity. In particular, Aberdeen and Peterhead were noted through STPR2 as having major freight tonnage movements. Access to the ports is likely to come at least in part from the A96, which increases HGV traffic on the routes.

As discussed above, these businesses are common along the A96, and therefore the corridor contains many businesses that are freight intensive.

Renewable energy is also a key emerging sector along the A96 corridor. In Moray, wind energy is being harnessed, with the Moray East offshore wind farm having the capacity to produce enough clean energy to power 950,000 homes, saving 1.4 million tonnes of CO 2 every year. ( Grampian Online (2021) Final Moray East wind turbine installation hailed by MP and MSP ) A second farm in Moray West is due to be operational in 2024/25. ( Moray West Offshore Windfarm (2020) About our wind farm ) Aberdeen and Aberdeenshire are also active in increasing their renewable energy output. The world’s largest floating offshore windfarm is based approximately 15km from Aberdeen, producing 50MW of energy since going operational in 2021, with the capability of powering more than 50,000 households per year. ( Offshorewind.biz (2021) World’s Largest Floating Offshore Wind Farm Fully Operational )