Appendix A

Purpose

The purpose of this paper is to share information with local authorities, RTPs and other interested parties, on the approach to Scenario Planning being undertaken in STPR2.

Introduction

The purpose of Scenario Planning is to ensure that anything which cannot be influenced is considered in the appraisal of that which is planned. The terminology is that which cannot be influenced is the ‘ Contextual Environment’ and that which is to be done is the ‘Transactional Environment’ . This is illustrated below for drivers of transport demand [note that not all these drivers will be used].

Demography

Car Ownership

Digital

Infrastructure

Vehicle Fleet

Natural Disasters

Taxation

Climate

Economy

Land-use

City and

Region Deals

Energy Resource Cost

Political

Leadership

Parking

Rail Franchise

Transactional

Environment

STPR2

Concessionary Fares

Trunk Road and Rail Infrastructure

Road Maintenance

Contextual

Environment

The Scenarios used in STPR2 will only include the factors which sit in the Contextual Environment . The factors in the Transactional Environment are NOT in scope as these may become part of the intervention i.e. they are potentially in-scope for Transport Scotland to influence. The exception to this is ‘committed interventions’ (e.g. A9 dualling) which are included in all scenarios.

The scenarios developed need to be coherent , credible and challenging . Coherent and credible is to be believable and relatable by decision makers and the public. Challenging is to ensure the appraisal of the interventions is rigorous, particularly in terms of taking account of uncertainty by considering a range of significantly different alternative futures.

The number of Scenarios needs to be practical. Whilst eight scenarios were developed for NTS2, those scenarios did not have any spatial differentiation within Scotland. To apply spatial differentiation to those scenarios (e.g. rural / urban / central belt / NE / SE / NW / SW) would create an impractical number of them. Lessons learnt from the NTS2 work also shows that many of the different drivers could be condensed down to two key parameters of; how many trips are being made and the cost of travel .

Scenarios can inform whether and / or when an intervention is needed; to keep the number practical, the scenarios for STPR2 focus on whether it is needed. In practice this means that the differences between scenarios will concentrate on factors such as the form and location of development and employment rather than on the how quickly or slowly change occurs.

Transport is a derived demand which leads to strong feedback loops between the various factors. Feedback between the STPR2 interventions and the Transactional Environment is relatively straightforward to deal with and will be captured in the appraisal process anyway. More challenging is when the feedback loops cross into the Contextual Environment such as when transport affects spatial accessibility as this feeds back through into land-use planning policy, demography and the economy. In other words: “ Society shapes Transport but Transport shapes Society .” Thus, the outcomes shown in the scenarios do not necessarily constitute a desired outcome. They are illustrations of what could happen under a given set of circumstances. The purpose of the STPR2 interventions is to help transform undesirable outcomes in the scenarios into desirable outcomes which support the NTS2 vision, priorities and outcomes.

In summary, the objective for the scenarios for STPR2 is to: Create a number of coherent, credible and challenging futures that explore the level of trip making resulting from changes in the contextual environment with a focus on creating significant spatial variation.

Proposed Scenarios

Taking into consideration the factors described above, a number of scenarios were planned to be developed comprising variants of spatial demographic / economic growth and policy ambitions. In the end, only two scenarios were developed as the policy ambition for a 20% reduction in car kilometres by 2030 dwarfed the effects of everything else.

Model Years: The base year is 2018. The forecast model years will be 2019, 2025, 2030, 2035, 2040 and 2045.

The following sections explain the key choices made in the proposed scenarios.

Spatial and Demographic Growth Factors

Economy and Employment

Both scenarios have the same overall economic growth over the period to 2050; this is a combination of long-term projections by Oxford Economics bought in 2019, the Scottish Fiscal Commission forecasts and more recently the OBR post-COVID estimates. Higher or lower growth will have little impact on whether an intervention is a ‘good idea’ but will impact only on when it would be needed or what the benefits are over the appraisal period. It also doesn’t provide any variation to the spatial distribution of growth.

Demography [Population and Households]

Only one population and household projection has been adopted [NRS 2018]. Similar to the overall economy issue, the change in both the population and the number of households will predominantly affect when a major transport intervention is needed rather than whether it is needed.

However, at a more local level, the most significant influence on higher or lower population in the future is due to migration which can change the structure of the population (e.g. if inward migration are economically active people and outward migration are retirees). In turn this will have impacts on the structure of households and in turn on the housing stock needed.

Using only one population and household projection, cognisance of different population structures may need to be considered separately in the appraisal for interventions particularly in regards to non-modelled impacts.

Land-use

Local Planning Policy is provided by the 34 Planning Authorities with NPF4 as part of the statutory development plan and will contain policies that don’t need repeated across all LDPs. In previous modelling, development has only been permitted to take place in those locations where development is allocated. If an area ‘runs out’ of land for a particular type of land-use then no further build-out of that land-use occurs beyond agreed rates of windfall. Further employment can occur though through intensification of use of existing land.

With increased working from home, it is expected that without redevelopment to other purposes the volumes of vacant office and retail space will rise even without additional allocations. Redevelopment of these spaces for residential use, taking cognisance of the higher development costs compared to greenfield sites, will be permitted to take place in the model.

City and Region Deals

City and Region Deals are ‘policy’ interventions designed to deliver outcomes. They comprise a variety of interventions including transport. Whilst there may not be a perfect alignment of the different Scottish Economy and Employment scenarios and the different city and region deals, in terms of scenarios with different magnitudes of employment and development, it’s considered that these are effectively captured within the proposed scenarios, as are other economic policies and investment types.

Development

2020-21 will reflect what is known or estimated about reduced completion of housing and other floorspace during the pandemic, but will assume that the construction industry can resume normal levels of activity afterwards (i.e. that there is no lasting loss of capacity in the industry).

Implications of increases in remote working

From 2021 onwards, household preferences will be adjusted to reflect the growing demand for space for working at home. The change will be concentrated on households whose occupations are more suitable for remote working, and on those age ranges which are less likely to have suitable space already (so households in the “older couple” category, who are likely to be “empty nesters”, are less likely to need additional space for working at home than, say, families with children). The value that households put on accessibility to work will also be reduced. There will be a parallel reduction in the requirement for floorspace per worker in sectors where remote working becomes more significant. Different levels of change will be made for the Transport Behaviour scenarios. Note that all of these changes will have consequences and resulting feedback effects, e.g. higher demand for housing from some household types will (to some extent) affect what is affordable for other household types.

Planning policy

Planning policy inputs (quantities of development permissible, by type, zone and year) from the APPI18 exercise used, but with the additional possibility after 2030 that vacant office or retail floorspace may be converted or redeveloped for housing. This will allow for reuse of (say) office floorspace in cases where growth in business services slows down.

Transport Behaviour Scenarios

The two transport behaviour scenarios are broadly capturing ‘without policy ambition’ (high) and ‘with policy ambition’ (low) levels of motorised traffic demand. The high traffic demand scenario is similar to a traditional ‘Do Minimum’ forecast. The low traffic demand scenario reflects the some current policy ambitions of the Scottish Government. This provides a much broader context with which to appraise STPR2 interventions.

The transport behaviour scenarios comprise what are considered to be the major drivers of high road traffic demand.

High Motorised Traffic / Emission demand (H)

This creates a Scenario based on choosing drivers in the contextual environment which lead to higher motorised traffic demand.

Vehicle Fleet

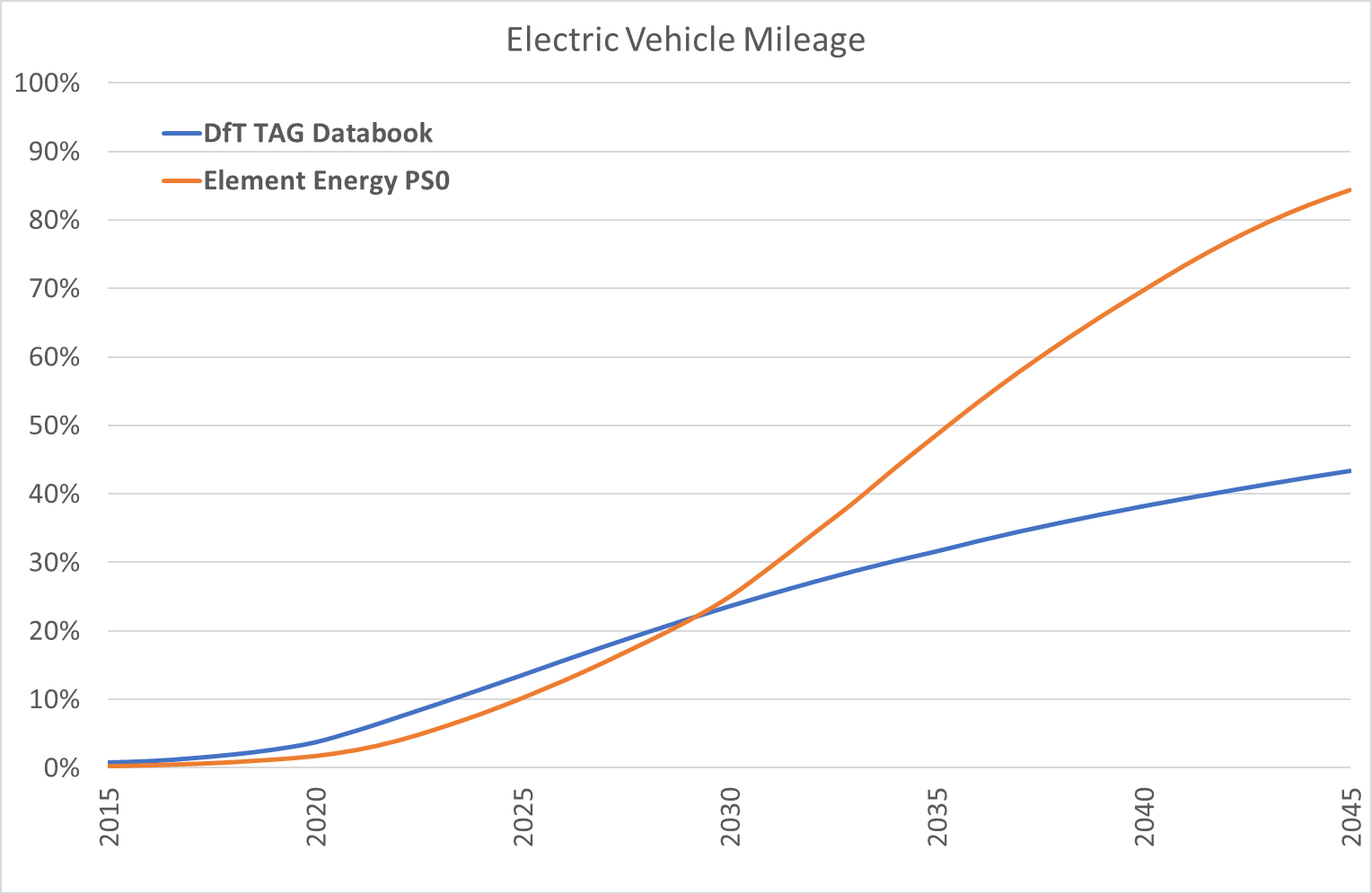

In previous forecasts, the vehicle fleet profile has followed that published in the DfT’s Transport Appraisal Guidance Unit A1.3. It is understood that the DfT acknowledge the current fleet profile in there is not up to date.

Transport Scotland have previously commissioned Element Energy to undertake modelling of the Scottish vehicle stock. A number of Policy Scenarios are available. Policy Scenario 0 (PS0) will be used as the forecast of Electric Vehicle Mileage in the absence of interventions (i.e. this does not include the ambition to phase out the need for new petrol and diesel cars by 2030). PS0 shows that by 2020 uptake of EVs has been slower than originally forecast by DfT but then grows more strongly.

Fuel / Energy Costs

In previous forecasts, vehicle efficiencies and fuel costs have followed that published in the DfT’s TAG A1.3. Key energy costs assumptions are that there is no duty on Electricity and 5% VAT compared to 20% VAT on fossil fuels and fuel duty between 50 and 65 p/litre (2010 prices). These costs will continue to be used in this scenario.

All other things being equal this combined with the increasing uptake of EVs generates significant traffic growth (average marginal cost for cars falls from 5.4 p/km in 2020 to under 3 p/km in 2050). Using similar costs, the DfT Road Traffic Forecasts 2018 had over 50% growth in vehicle miles for their scenario with high shift to EVs.

Parking Supply, Cost and Car Ownership

In previous forecasts non-residential parking supply has been assumed to be market-driven; i.e. if there is a demand for parking then supply will be provided. Where there are Parking Costs these have been assumed to rise in line with RPI.

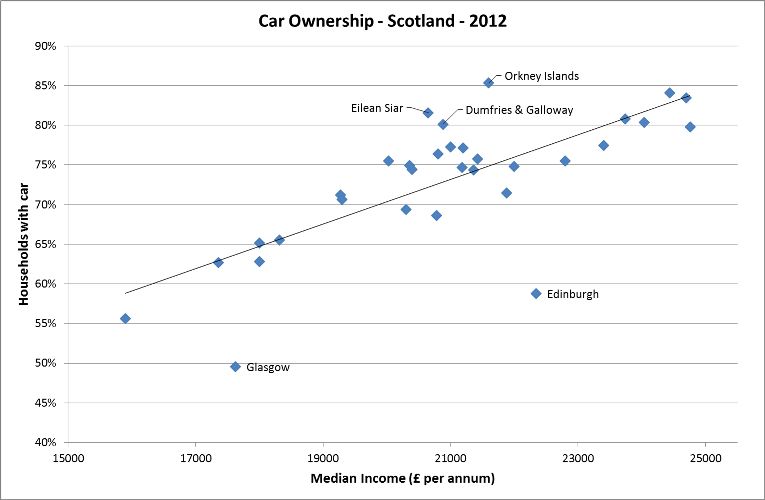

A lack of residential parking supply can affect car ownership. This is potentially an issue in Glasgow and Edinburgh where the number of households with a car is substantially below that expected based on the median income in these local authorities.

In the High scenario, future car ownership will only be constrained in city centres (not the whole city) where there are existing parking constraints.

Post COVID19 Working Behaviours and Trip Rates

COVID19 has demonstrated that up to 40% of the working population are able to work from home. Post-COVID19 some people / employers will choose to continue to work from home, others will return to working in an office full-time and others will blend their working week between home and office. It will be assumed post-COVID19 that 15% of commute journeys will be no longer be undertaken; this will be allocated to different professions as appropriate. As the economy grows in different ways (see earlier) the overall proportion of people working from home will vary over time.

Related to employment are business trips. Some of these are now likely to take place digitally compared to pre-COVID19. It will be assumed post-COVID19 that 33% of business journeys will be no longer be undertaken.

For other journey purposes other than commute and business travel, trip rates will be kept constant over time. Whilst there is likely to be a rise in online retail for example, it’s considered that any decrease in trips to shop will be partially offset by increased delivery trips. Historically there is also some evidence that when one type of trip purpose declines, others are substituted [ NTS0403 ].

Trip Timing

With more ability to work flexibly, those who are commuting to work could take advantage of travelling when congestion is less on the roads or fares are lower on the train. The current models do not include a ‘time of day’ choice. As there is currently no evidence on a post-COVID19 time of day change, no changes will be made to trip timing.

Transport Technology and Disruptors

The most significant Disruptor Technology leading to high traffic demand is the potential of Connected Autonomous Vehicles (CAVs) particularly if they are used in the same way as private cars are currently (i.e. no significant increase in sharing). A 40% uptake of CAVs in 2050 has been assumed as optimistic with the first CAVs appearing in the mid 2020s. [loosely based on analysis by Deloitte ]. The main impact of CAVs is to enable people who are currently unable to drive to become the equivalent of ‘car drivers’. By 2050, particularly with the availability of ‘shared user’ CAVs makes all adults ‘car available’. The trip rate for retired people will be set to the same as for ‘working age unemployed’.

Low Motorised Traffic / Emission demand (L)

This creates a Scenario in line with various desired policy outcomes and outputs.

Future Policies: Ambitions, Targets, Outcomes or Outputs

These go by a variety of names but are all quantified visions of the future such as

20% reduction in car.km. by 2030

Phase out the need for new petrol and diesel cars and vans by 2030

Net zero carbon emissions by 2045

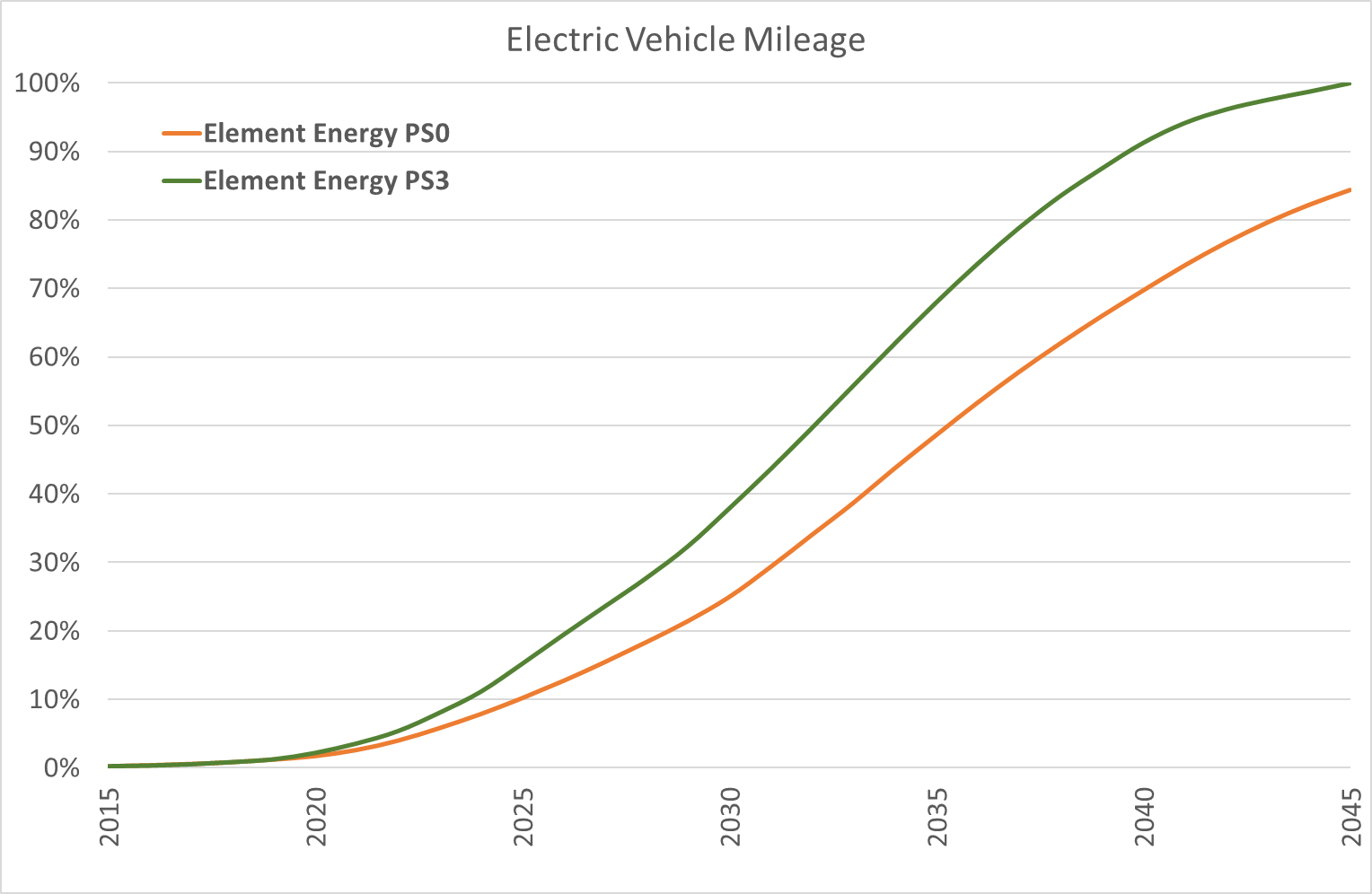

Vehicle Fleet

Using previously commissioned Element Energy to undertake modelling of the Scottish vehicle stock Policy Scenario 3 (PS3) will be used as the forecast of Electric Vehicle Mileage (this does include the ambition to phase out the need for new petrol and diesel cars by 2030).

Parking Supply, Cost and Car Ownership

No change to parking supply or cost compared to the High Traffic scenario.

Future car ownership will only be constrained in all cities (i.e. the whole city) to numbers in 2020.

Post COVID19 Working Behaviours and Trip Rates

It will be assumed post-COVID19 that 25% of commute journeys will be no longer be undertaken; this will be allocated to different professions as appropriate. As the economy grows in different ways (see earlier) the overall proportion of people working from home will vary over time.

It will be assumed post-COVID19 that 66% of business journeys will be no longer be undertaken.

For other journey purposes other than commute and business, trip rates will follow the trend of decline in trips rates observed over the last decade.

Trip Timing

No changes will be made to trip timing compared to the High Traffic scenario.

Transport Technology and Disruptors

The most significant Disruptor Technology leading to high traffic demand is the potential of Connected Autonomous Vehicles (CAVs) particularly if they are used in the same way as private cars are currently (i.e. no significant increase in sharing). This scenario will assume that CAVs do not make it to market before 2050.

Fuel / Energy Costs

Achieving the 20% reduction in car mileage by 2030 is likely to be achieved through a programme of different interventions. Each of these interventions will require a business case and depending on the scale to which they are implemented will contribute towards the reduction by different amounts. Ultimately though, the reduction can only be achieved through reducing the number of trips [see ‘Post COVID19 Working Behaviours and Trip Rates above] and reducing the distance driven. The distance driven by private car is proportionate to the generalised cost of driving. The generalised cost of driving comprises the time taken to make a journey, the cost of fuel, vehicle operating costs, car parking costs and ‘tolls’ (although no tolls currently apply). Thus, the generalised cost of car driving will be increased such that the 20% reduction in car mileage is achieved by 2030. After 2030, the generalised cost of driving will increase with inflation.

Committed Interventions

If an intervention is considered ‘committed’ it will included in all the scenarios. In addition to the ‘ committed ’ interventions in the last version of TMfS, the following major interventions are now included.

A9 and A96 Dualling will be considered as committed including:

A9/A96 Inshes to Smithton Link Road

A9/A82 Longman Roundabout grade separation

Additional Rail commitments include:

East Linton and Reston stations

Levenmouth Rail

Winchburgh